Wolfpack’s Short Attack on Skillz: What Does Insider Transaction and Short Selling Data Tell Us?

Shares in mobile gaming operator Skillz (SKLZ:US) have fallen recently after prominent short-seller Wolfpack Research published a critical report on the company.

In the report, entitled ‘SKLZ: It Takes Little Skill To See This SPACtacular Disaster Coming,’ Wolfpack stated that SKLZ’s growth projections are “entirely unrealistic” and that the growth story is “falling apart.”

Whenever a company is hit by a short-selling attack, it’s worth examining data on insider transactions and short selling for insights. This kind of data can help investors cut through the noise and find out what’s really going on at the company.

So, let’s take a look at the data on Skillz to see if it provides any valuable insights in relation to the short attack.

Wolfpack’s Report on Skillz

Before we analyze the data on Skillz, let’s examine Wolfpack’s claims.

1/ We are short $SKLZ because its top games appear to be stagnant to declining, leading us to believe its projections are farcical and intended to dump this SPAC on retail investors at the highest valuation possible https://t.co/xW3vJzUadw

— Wolfpack Research (@WolfpackReports) March 8, 2021

In its report, Wolfpack states that it is shorting Skillz stock because:

Skillz’s top games appear to be stagnant to declining, and that its revenue projections are “farcical.”

Its research, including conversations with former employees, employees of Skillz’s two largest developers, and independent third-party app download data, all suggest that the growth projections SKLZ and its SPAC sponsor continue to present to investors are “entirely unrealistic".

SKLZ’s top three games, representing ~88% of its revenues, plateaued in Q3 2020.

While SKLZ is projecting 12.3% sequential revenue growth and 61.4% year-over-year revenue growth in Q1 2021, third-party app data shows that SKLZ’s total installations are down double digits through the first two months of Q1 2021.

Former employees of Skillz referred to the company’s numbers as “smoke and mirrors.”

Skillz’s “conveniently-timed” partnership with the NFL has very little basis. Skillz’s developer portal showed no evidence of an NFL deal or contest being held and Wolfpack was unable to find any reference to this purported partnership from the NFL’s side, other than SKLZ press release itself.

To meet its projected 61.4% YoY growth in 1Q21 after such poor numbers in January and February, $SKLZ would need 3.6 million downloads in March alone. This is more than double the downloads $SKLZ has ever had in a single month. pic.twitter.com/BxU7Grk4QP

— Wolfpack Research (@WolfpackReports) March 8, 2021

Wolfpack sums up its research by stating:

“This appears to be another SPAC preying on retail investors by obtaining a ridiculous valuation for the SPAC merger based on self-serving projections."

No Reply From Skillz

It’s worth noting that Skillz has not responded to Wolfpack’s accusations. This is quite unusual. Usually, if a company believes that a short seller’s accusations are unfounded, it will immediately publish a statement defending itself.

For example, after Wolfpack launched a short attack on EHang in February, the drone manufacturer came out and stated that Wolfpack’s report contained “numerous errors, unsubstantiated statements, and misinterpretation of information.” Similarly, after Viceroy Research hit Grenke AG with a short attack last year, the German Leasing company immediately defended itself.

CEO Andrew Paradise did post an open letter to investors on Seeking Alpha on 8 April. However, this did not address any of Wolfpack’s accusations.

Insider Transaction Activity at Skillz

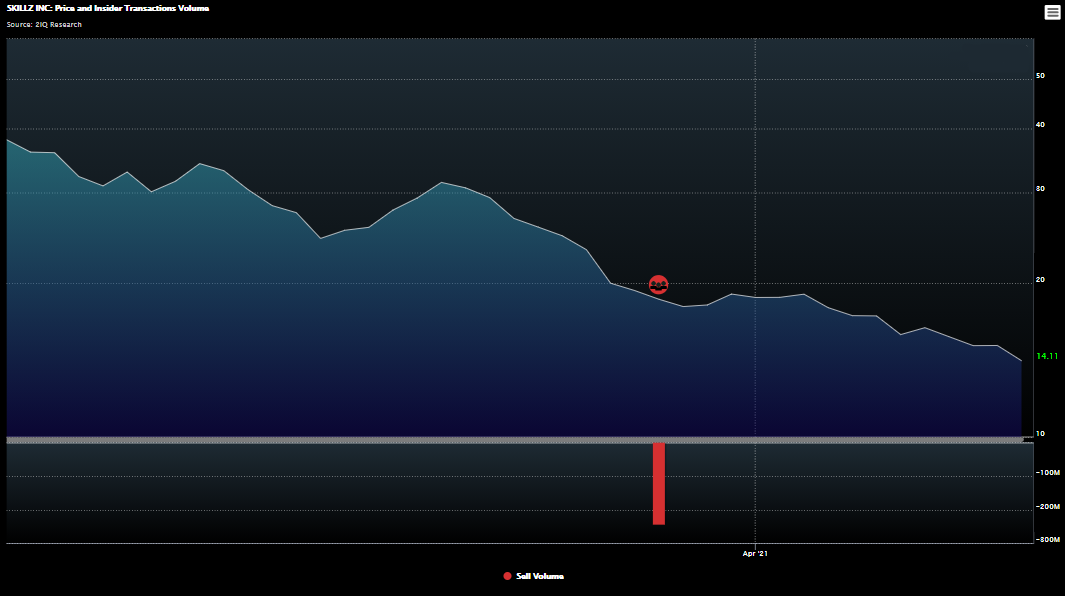

Turning to the insider transaction data, it’s interesting to see that five insiders recently offloaded large amounts of company stock. This stock was sold to underwriters in connection with a registered secondary offering of 32,000,000 shares.

Those who sold stock included:

CEO Andrew Paradise – 8.4 million shares

Chief Revenue Officer Casey Chafkin – 1.7 million shares

CTO Miriam Aguirre – 274,825 shares

Vice President Charlotte Edelman – 30,340 shares

Independent Director Kent Wakeford – 42,465 shares

Combined, these insiders sold about $243 million worth of SKLZ stock.

This amount of insider selling immediately after a short attack is not a good look for Skillz. That said, our data shows that all of these insiders still own a large number of shares after these sales. Mr. Paradise, for example, currently owns 68.6 million shares. Mr. Chafkin, meanwhile, owns 12.6 million shares. So, all of these insiders still have considerable ‘skin in the game.’

Short Selling Activity

Moving on to short selling, our securities lending data shows that currently, there are 46.5 million shares short. Skillz has 326,316,000 million shares in issue which means that short interest is a high 14.3%. This level of short interest is slightly concerning. It suggests that a number of sophisticated investors are betting against the stock right now.

Digging deeper into the short side data, we can see that, as of 16 April, utilization was a high 95.1%. Utilization refers to the number of loaned shares divided by the available shares in the securities lending market, expressed as a percentage. It is essentially a ratio of demand to supply. The high utilization rate here tells us that there is a strong demand to short the company’s stock relative to the number of available shares.

Meanwhile, FINRA’s short data shows that there has been an increase in the number of SKLZ shares shorted recently.

Source: FINRA

Source: FINRA

360% Share Price Rise

It’s worth highlighting the rise in Skillz’s share price since its SPAC merger deal in order to put all of this data in context.

After Skillz began trading on the New York Stock Exchange in mid-December 2020, its share price took off. In early February 2021, the stock hit $46 – 360% higher than the company’s offering price of $10. Much of this gain was due to the company’s announcement of its multi-year gaming agreement with the NFL.

After a 360% share price in the space of a few months, it is not so surprising that the stock has attracted attention from short-sellers.

Even after the recent share price fall, SKLZ stock remains expensive. Currently, the stock sports a market capitalization of around $6.0 billion. However, the consensus sales forecast for FY2021 is just $370 million. This means that the forward-looking price-to-sales ratio is approximately 16.2. That’s a high valuation.

Skillz: A Number of Red Flags

Putting this all together, we think caution is warranted towards Skillz stock right now. Not only has the stock seen large sales from insiders but it has also seen a rise in short interest recently. These are both red flags. Additionally, the valuation remains high and the stock is locked in a downtrend, which suggests that investors are losing confidence.

Going forward, we think it’s worth monitoring the insider transaction data closely. If insiders are confident about the future, we would expect to see some substantial insider buying at Skillz in the near future.

Latest Stories

Ralliant’s Insider Cluster Signals Long-Term Confidence Amid EV Headwinds

CVCO Insiders Buy the Dip After Earnings Shock

Insiders Signal Bullish Outlook on Crane with Strategic Purchases

The Buyback Dataset: Tracking Corporate Share Repurchases

Insiders Buy USA Rare Earth as Supply Chains and Policy Align