Eastman Leadership Rallies Behind Stock Amidst Mixed Results

Eastman Chemical Company (EMN:US), the Kingsport-based specialty materials giant founded in 1920, is navigating a challenging economic environment while pushing forward with strategic initiatives. With a workforce of about 14,000 and customers in more than 100 countries, Eastman generated $9.4 billion in revenue in 2024 and maintains leading positions across transportation, construction, and consumer end markets.

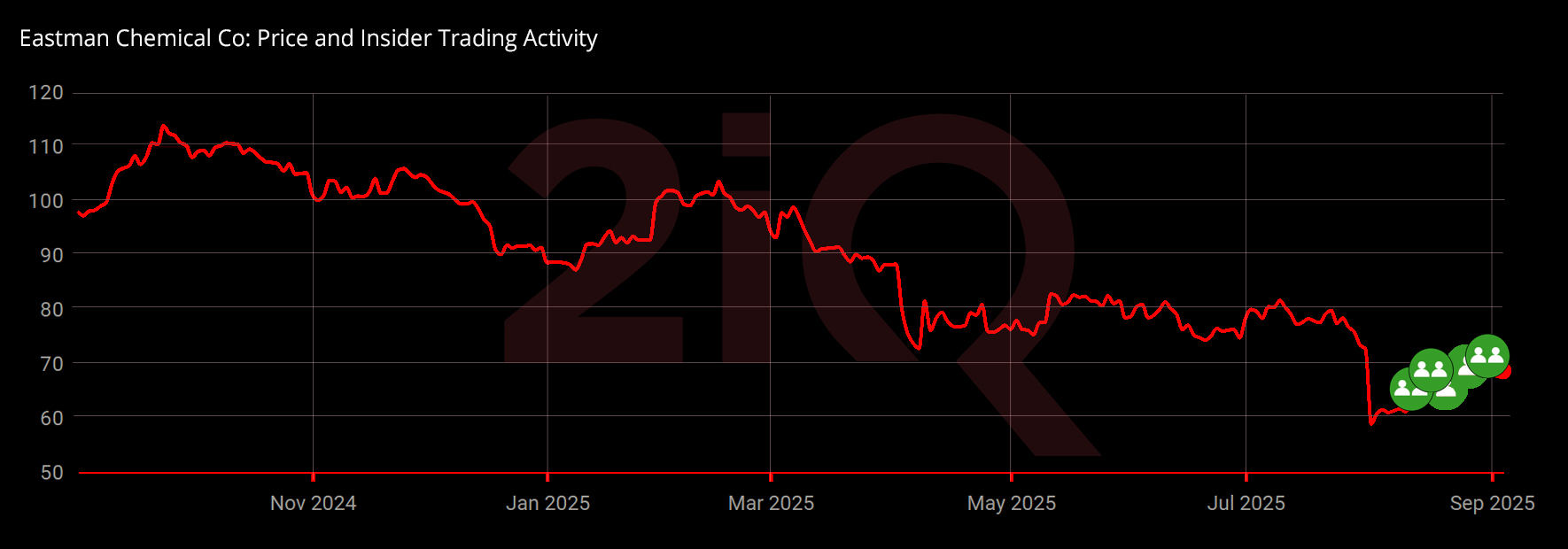

Coordinated Insider Buying Underscores Leadership Confidence

On August 27, 2025, multiple senior executives and directors made significant insider purchases, collectively worth nearly $2 million, signaling strong confidence in the company’s long-term outlook.

CEO & Chairman Mark J. Costa led the buying with 7,400 shares acquired at $67.89, totaling $502,386, boosting his holdings to 453,986 shares.

COO Brad A. Lich purchased 3,280 shares at $68.49, spending $224,647 and lifting his stake to 83,487 shares.

CFO William Thomas McLain Jr. acquired 3,670 shares at $68.73, worth $252,239, increasing his total holdings to 53,524 shares.

SVP Julie A. McAlindon bought 2,000 shares at $68.429, valued at $136,858, bringing her holdings to 12,731 shares.

SVP Brian Travis Smith added 1,750 shares at $68.34, spending $119,595 and raising his total to 16,732 shares.

Alongside these moves, several board members also showed conviction through their purchases. Directors Damon J. Audia, Brett D. Begemann, Eric L. Butler, Julie Fasone Holder, Kim Ann Mink, and James J. O’Brien collectively acquired around 9,000 shares valued at approximately $606,000. Their individual trades ranged between $99,000 and $205,000 each, further reflecting strong insider alignment across the boardroom.

Financial Backdrop

Second-quarter 2025 results reflected ongoing macro pressures. Sales declined to $2.29 billion from $2.36 billion a year earlier, while adjusted EBIT dropped to $275 million from $353 million. Adjusted EPS fell to $1.60 from $2.15. Management highlighted stable performance in specialty segments and progress in circular economy initiatives, including record production at its methanolysis plant. However, tariffs, global uncertainty, and an unplanned $20 million outage weighed on results.

Dividends and Strategic Expansion

Reaffirming its commitment to shareholder returns, Eastman’s board declared a quarterly dividend of $0.83 per share, payable October 7, 2025. At the same time, Eastman announced a strategic partnership with Huafon Chemical to establish a cellulose acetate yarn facility in China, expanding capacity for its sustainable Naia™ product line and deepening its presence in the world’s largest textile hub.

Looking Ahead

The heavy insider buying, steady dividend, and new international partnership provide rare optimism amid a difficult operating climate. Investors will be watching closely to see if Eastman’s resilience and innovation-driven growth strategy can overcome persistent global headwinds.

Latest Stories

Coty Insiders Buy Over $1.3M in Shares After Earnings Miss

Hays Leadership Shows Faith in Stock While Markets Remain Skeptical

Energy Transfer’s Exec Chairman Invests $34M Amid Expansion Plans

Uber’s $20 Billion Buyback Plan Underscores Confidence Amid Record Q2 Earnings

Lilly Leaders Show Faith with $4.5M in Stock Purchases