Hays Leadership Shows Faith in Stock While Markets Remain Skeptical

Hays plc (HAS:LN), the FTSE 250-listed recruitment specialist, is navigating one of its toughest periods in decades. With operations spanning 33 countries and deep specialisation across industries from technology and finance to healthcare and engineering, Hays has long been seen as a bellwether for global hiring trends.

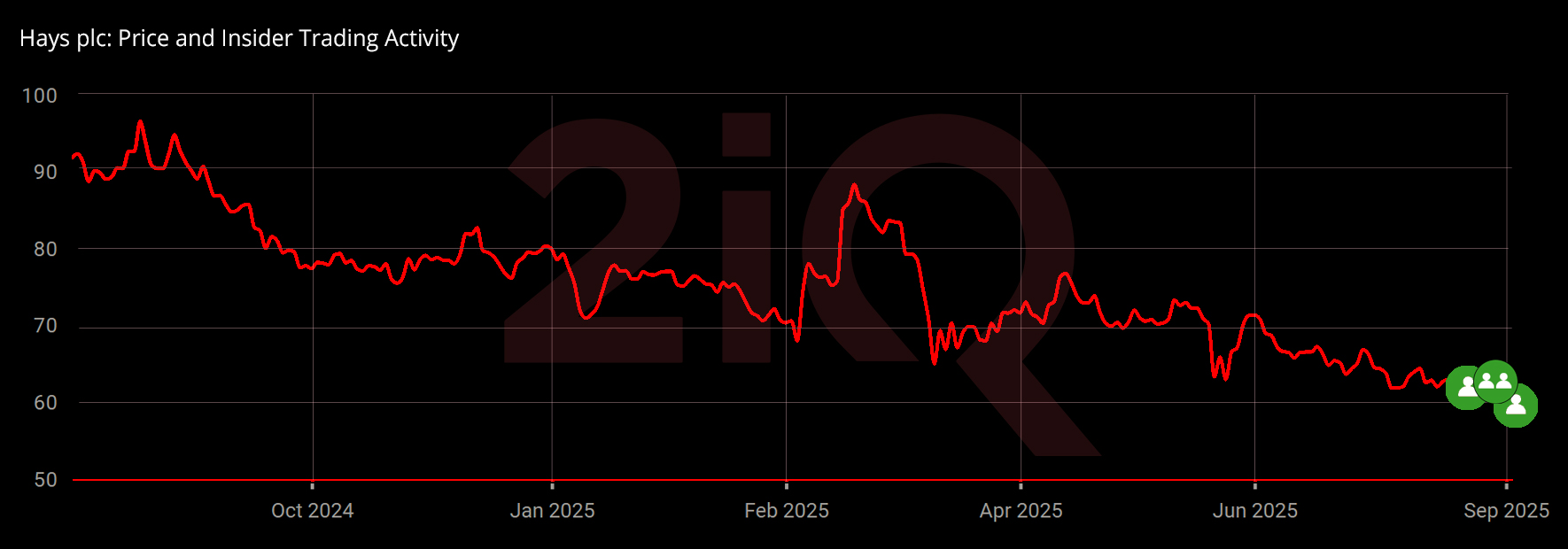

As of late August 2025, the company’s market capitalisation hovers just under £1 billion, reflecting a sharp erosion of investor confidence after months of profit warnings, dividend cuts, and persistent weakness in global recruitment demand.

A Wave of Insider Buying

Despite the gloomy backdrop, recent regulatory filings reveal a striking pattern: top executives and directors are buying shares in bulk.

CEO Dirk Hahn acquired 364,000 shares at £0.615 on 28 August, spending more than £224,000. Just days earlier, on 22 August, he had already bought 130,000 shares at £0.641, adding £83,274 more to his stake. Together, Hahn has invested over £307,000 in the space of a week.

CTO Mark Dearnley made an even larger move, purchasing 387,000 shares at £0.646, for a total outlay of around £250,000.

Chairman Michael Alan Findlay also bought in, adding 33,415 shares at £0.596, spending roughly £19,800.

Independent director Joe Hurd chipped in as well, with a smaller but symbolic 1,923-share buy at £0.643.

Taken together, these trades show that Hays’s leadership is not just talking up a long-term recovery, but they are putting personal capital on the line.

Why These Trades Matter

Insider transactions are often scrutinised because executives and directors have unparalleled visibility into a company’s health and prospects. In Hays’ case, the scale and timing of these moves are particularly significant. Both the CEO and CTO committed six-figure sums within days of each other, right in the middle of one of the company’s darkest financial quarters. The fact that the purchases came from different levels of leadership, from technology operations to independent board oversight, shows alignment across the organisation. While many external investors have been selling off the stock, these insiders are leaning in, suggesting they may believe the worst is behind them.

The Financial Backdrop

To understand why this insider confidence stands out, one must consider the financial state of Hays. Pre-tax profits for FY2025 fell by 90 percent year-on-year, collapsing to just £1.5 million compared with £14.7 million previously. In response, management slashed the dividend by 59 percent, a drastic step that highlighted the need to preserve cash. The global hiring market itself has been described by Hays as the longest slump since 2000, with fee income dropping across nearly every sector and region. Earlier this summer, the company warned investors to expect operating profits to more than halve to about £45 million, marking one of its most sobering downgrades in years.

Reports from The Times, The Guardian, and Financial Times underline just how challenging the environment has become, with no immediate signs of recovery on the horizon.

Why Insider Confidence Matters Now

With profits collapsing, dividends cut, and the hiring market in decline, insider buying carries unusual weight. Executives only gain if the stock recovers, and the scale of purchases by Hahn and Dearnley suggests they see the shares as undervalued. Their confidence may stem from restructuring efforts, hopes of a demand rebound, or simply the belief that sentiment has become overly negative.

For investors, the real question is whether Hays has reached the bottom of the cycle. September trading will be crucial in setting the tone for FY2026, and trends in net fee income will be closely watched. Continued insider accumulation would further strengthen the signal. Until then, markets remain cautious, but the heavy buying by Hays leadership stands out as a rare show of optimism in difficult times.

Latest Stories

Energy Transfer’s Exec Chairman Invests $34M Amid Expansion Plans

Uber’s $20 Billion Buyback Plan Underscores Confidence Amid Record Q2 Earnings

Lilly Leaders Show Faith with $4.5M in Stock Purchases

Shift4 Chairman Makes Bold Insider Purchase Amid Strong Q2 Results

What’s Behind the Nearly $1 Million Insider Buying at Insperity?