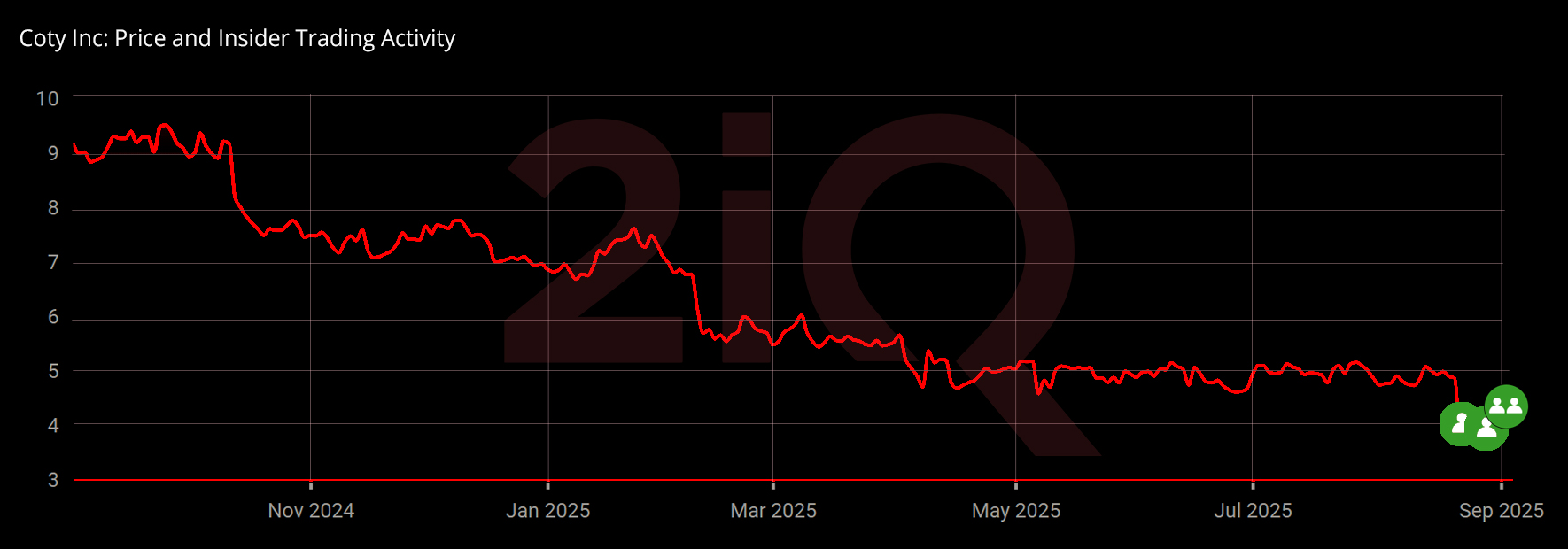

Coty Insiders Buy Over $1.3M in Shares After Earnings Miss

Coty Inc (COTY:US) is one of the world’s largest beauty and fragrance companies, home to brands such as Gucci, Burberry, and CoverGirl. Operating across Prestige and Consumer Beauty segments, Coty has a market capitalization of around $3.82 billion.

Insider Buys on August 22 – September 3

The latest insider filings revealed a cluster of notable purchases:

Sue Youcef Nabi (CEO) - Bought 260,000 Class A shares on August 22 at $3.92, investing about $1.02 million.

Priya Srinivasan (HR Director) - Purchased 30,000 shares on August 22 at $3.84, worth $115,200.

Laurent Serge Mercier (CFO) - Acquired 12,500 shares on August 25 at $3.96, totaling $49,500. Bought an additional 3,000 shares on August 26 at $3.84, worth $11,517.

Kristin Ely Blazewicz (CLO) - Purchased 29,400 shares on September 3 at $4.30, an investment of $126,909.

These transactions stand out not only for their size but also for the timing, coming shortly after Coty’s disappointing quarterly earnings. Nabi last purchased shares in 2022, making this her first insider buy in several years.

The Insiders Behind the Trades

Sue Nabi, Coty’s CEO since 2020, is a veteran of the beauty industry with decades of leadership experience. Her latest million-dollar buy isn’t just about numbers since insiders like Nabi often have a deep understanding of company performance and prospects. When such leadership steps in with personal capital, it can be a strong expression of confidence in the path forward.

Priya Srinivasan, Coty’s HR Director, may not typically grab investor headlines, but her purchase alongside the CEO reinforces the sense of alignment across Coty’s top ranks. Insider buying at multiple levels often signals that leadership believes the market is undervaluing the business.

Financial and Market Context

Coty’s recent fiscal Q4 results came in weaker than expected, including a surprise quarterly loss. Management cited retailer destocking and softer consumer demand as key challenges..

Coty shares dropped more than 20% following the news. That selloff reflected investor concerns about retailer destocking and soft demand.Despite this, Coty emphasized that its turnaround strategy remains on track, with expectations for growth to return in the second half of fiscal 2026, and just the day after the steep decline, Nabi and Srinivasan stepped in to buy, an action that frames their trades as opportunity buying rather than routine accumulation. By investing in the middle of a downturn, Coty’s leadership is signaling conviction that the stock’s long-term value outweighs the short-term volatility.

Latest Stories

Eastman Leadership Rallies Behind Stock Amidst Mixed Results

Hays Leadership Shows Faith in Stock While Markets Remain Skeptical

Energy Transfer’s Exec Chairman Invests $34M Amid Expansion Plans

Uber’s $20 Billion Buyback Plan Underscores Confidence Amid Record Q2 Earnings

Lilly Leaders Show Faith with $4.5M in Stock Purchases