Four insiders at Repay Holdings (RPAY:US) buy stock

C-suite executives tend to have a good understanding of their companies’ operating activities. If these insiders are buying company stock, it’s often a sign that the outlook for the stock is attractive.

In this report, we are going to highlight some interesting buying activity from top-level insiders at Repay Holdings Corp (RPAY:US). Repay provides integrated payment processing solutions to verticals that have specific transaction processing needs. Its platform is designed to reduce complexity while enhancing the overall experience for consumers and businesses. It’s listed on the Nasdaq and currently has a market cap of approximately $713.72 million.

Insider buying at Repay Holdings

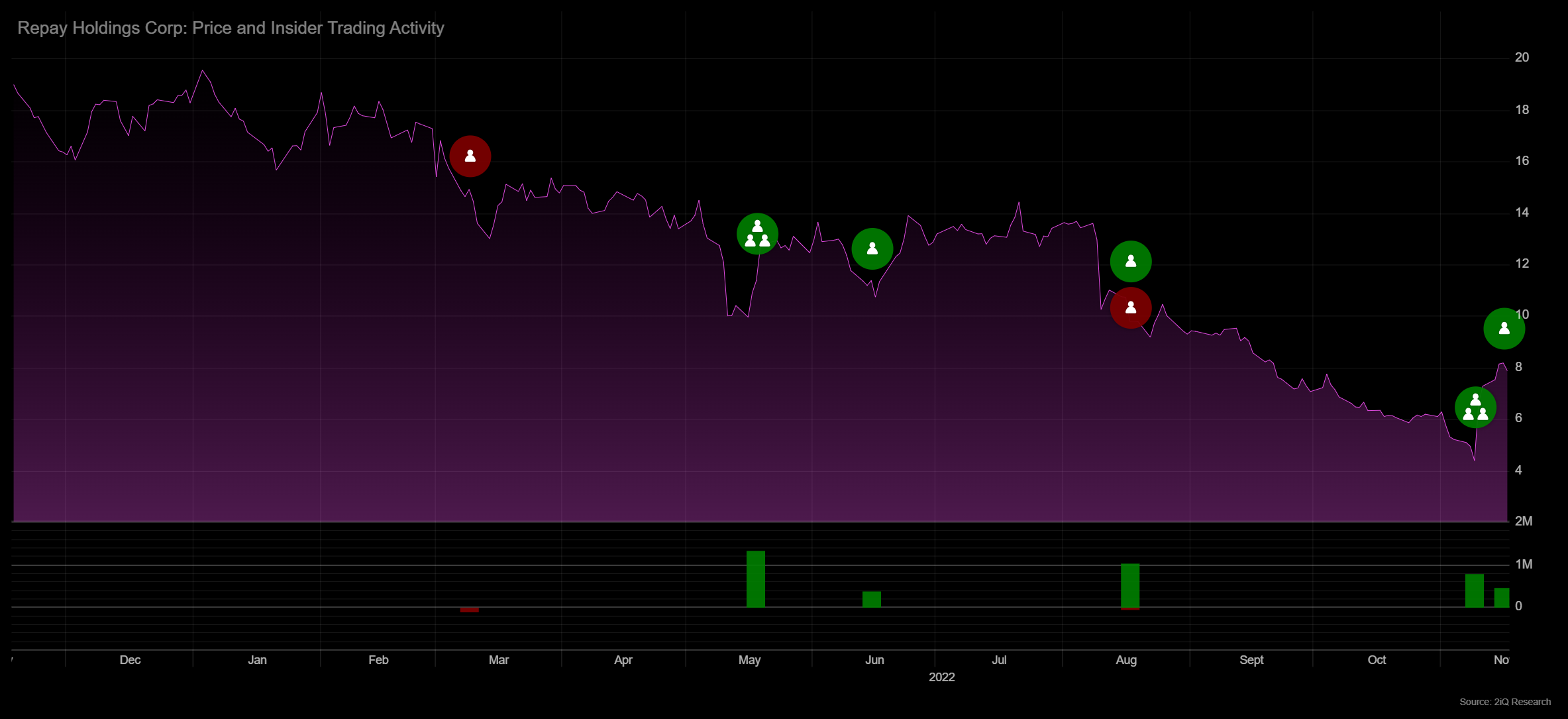

Our data shows that between November 11 and November 14, four insiders at Repay purchased stock. Those who bought shares were:

CEO and Co-Founder John Morris (15,000 shares @ $6.87 per share)

President and Co-Founder Shaler Alias (75,000 shares @ $6.87 per share)

CFO Tim Murphy (26,000 shares @ $6.87 per share)

Chairman Peter Kight (65,000 shares @ $7.41 per share)

In total, the four insiders invested $1,278,570 in company stock.

Top-level insiders

All three of these insiders are likely to have an excellent understanding of Repay’s prospects.

Mr. Morris co-founded the company in 2006 and currently oversees its overall strategic and financial direction, including market strategy, organic and inorganic growth, and new end-market development. Overall, he has over 20 years of experience as an innovator and entrepreneur in the payments and financial technology industry.

Mr. Alias, who also co-founded the business, oversees the strategic direction of the company and is responsible for creating and managing all third-party relationships critical to the business. Meanwhile, Mr. Murphy is responsible for all financial operations of the company including finance, planning, accounting, tax, treasury, reporting, and corporate development.

It’s worth noting that these three individuals aren’t the only insiders to buy Repay stock recently. We can see that in August, Chairman Peter Kight bought more than $1 million worth of stock. Mr. Kight has an investment background and has served as Chairman since the business was formed.

Solid growth

Repay Holdings recently posted solid results for Q3.

For the period, revenue came in at $71.6 million, up 17% year on year. Adjusted EBITDA came in at $31.7 million, up 30% year on year.

On the back of these results, Repay reiterated its guidance for 2022. For the full year, it expects revenue of $268-$286 million (2021: $219.3 million) and adjusted EBITDA of $118-$126 million (2021: 93.2 million).

Looking ahead, management was confident in relation to the company’s growth prospects.

“We remain encouraged by our addressable market opportunity, as the B2B and consumer payment verticals we target represent over $5 trillion of combined annual payment volume. We also remain very encouraged by the continued tailwinds in our business, including the ongoing secular trends away from cash and check towards digital, embedded payments. We believe those opportunities – along with our unique offering, technology platform, and our exceptional team – position us well for long term, sustainable growth,” said CEO John Morris.

In light of this confidence from management, we see the insider buying here as a bullish indicator.