FedEx (FDX:US) Insiders Buys $442.5K Worth of Stock

Corporate insiders have access to real-time business data and often also have a wealth of experience that can help them evaluate their firms’ prospects. If they are buying company stock, it’s generally worth taking a closer look.

In this report, we are going to highlight some interesting insider buying at FedEx Corp (FDX:US). FedEx is an American multinational courier delivery services company. The world’s largest express transportation company, it operates in more than 220 countries, making around six million shipments every day. The company is listed on the New York Stock Exchange and currently has a market capitalization of around $57.68 billion.

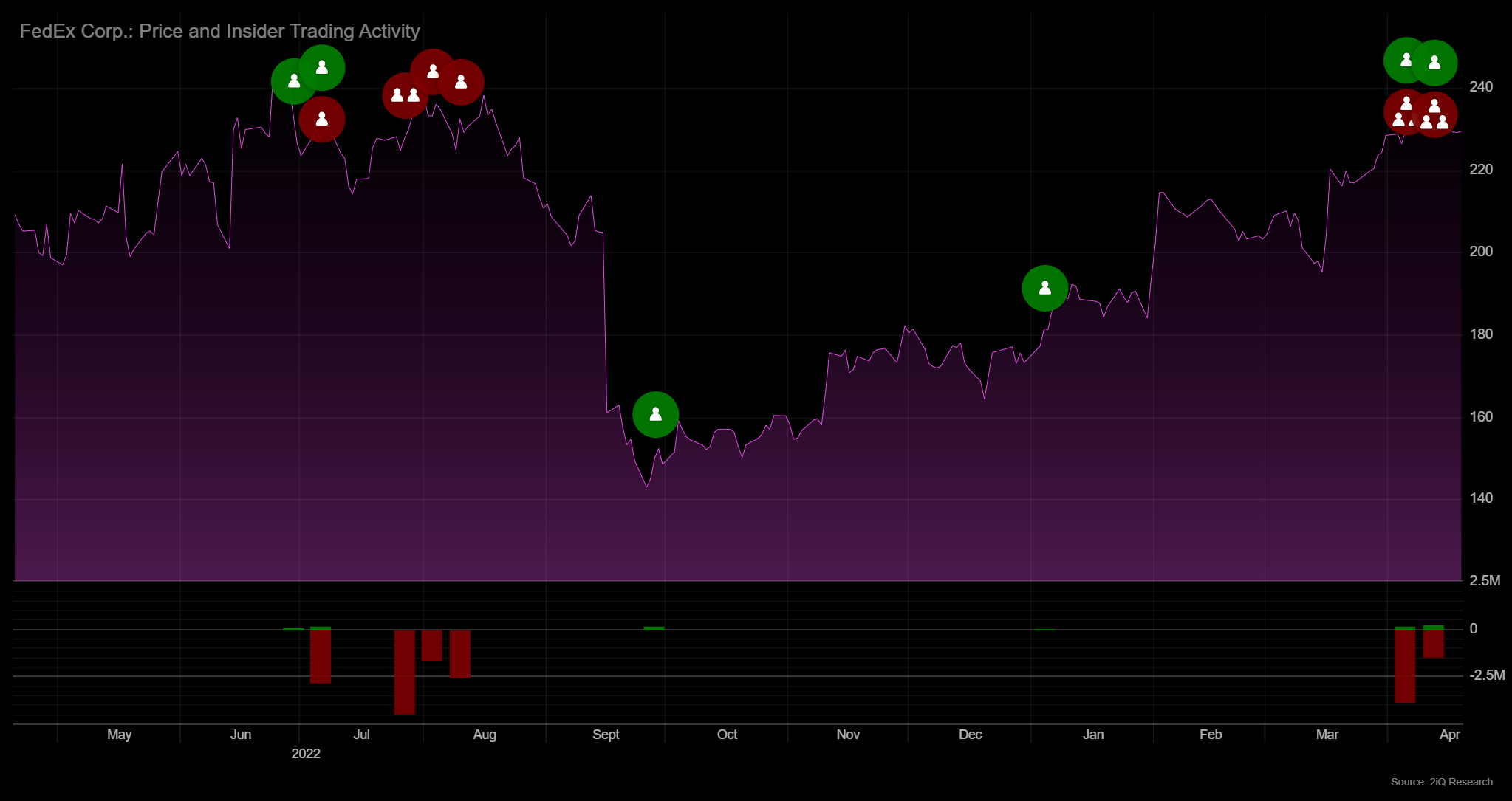

Insider Buying at FedEx

2iQ data shows that on April 6, board member Amy Lane bought 830 FDX shares at a price of $232.88 per share. This trade cost the insider approximately $193,290 and increased her holding to 2,359 shares.

Meanwhile, board member Stephen E. Gorman purchased 1080 shares of FDX on April 12, with a single share trading at $230.75, totalling the investment to $249,210 in value. After the latest buying, the total holdings of the insider calculate to 1,258 shares.

Investment Background

Both of these insiders hold immense expertise in their respective fields and have worked in top-tier positions in their recent endeavors.

Firstly, Ms. Lane has an investment background. Previously, she was a Managing Director of the Global Retailing Investment Banking Group at Merrill Lynch & Co. She also served as a Managing Director at Salomon Brothers, where she founded and led the retail industry investment banking unit.

Secondly, Stephen E. Gorman is a business-oriented genius who has been the head of seven different companies. Presently, Mr. Gorman holds the position of President, CEO & Director at Sistema Internacional de Transporte de Autobuses, Inc. and President & CEO at Greyhound PackageXpress. He is also on the board of 7 other companies.

Given the insiders background, they are likely to have a good understanding of FedEx’s intrinsic value.

Restructuring

Earlier this month, FedEx announced plans to restructure its business. The aim of the restructuring is to create greater flexibility and efficiency and further reduce costs.

As part of its restructuring plan, the company will consolidate its operating companies into one organization. It believes that this will enable it to slash operating costs by $4 billion by the end of fiscal 2025.

This development was received well by Wall Street. Analysts at Credit Suisse said that this is the right strategy to unlock value while analysts at TD Cowen said that the restructuring outlines the path to a more nimble, higher-margin business. On the back of the news, several brokers raised their price target for the stock.

It’s worth noting that in the announcement, FedEx also announced a dividend increase. For fiscal 2024, the board of directors approved a payout of $5.04 per share.

In light of these developments, we see the insider buying here as a bullish signal.

Latest Stories

Top 5 Insider Trades of 2025: Confidence in the Market from the Inside

Grizzly Short Hits Trustpilot Amid Harsh Review-Manipulation Claims

Grindr Surges After Billionaire Owner Withdraws Buyout Bid and Buys Shares

Leadership Betting on the Adtran Holdings’ Future

Tutor Perini Leadership Shows Confidence with Multi-Million Dollar Buys