Top 5 Insider Trades of 2025: Confidence in the Market from the Inside

Insider trading often provides a rare glimpse into the confidence and expectations of a company’s leadership. In 2025, several high-profile insider transactions drew attention, signaling strategic bets across diverse industries. Let’s explore the top five insider trades that captured market interest and the context behind these moves.

Eli Lilly and Company: $4.5M Insider Cluster Amid Market Dip

Eli Lilly and Company (LLY:US), the Indianapolis-based pharmaceutical giant, saw a surge in insider buying following a sharp stock dip in August 2025. Multiple executives, including CEO David Ricks, CFO Lucas Montarce, and President Jake Van Naarden, collectively spent $4.5 million acquiring shares.

The purchases followed a 14% single-day decline triggered by underwhelming results from the oral obesity drug orforglipron, though Lilly’s Q2 financials remained strong: $15.56B revenue (+38% YoY), adjusted EPS $6.31, and blockbuster growth from Zepbound (+172%) and Mounjaro (+68%).

By investing heavily during a downturn, Lilly insiders demonstrated faith in the company’s pipeline and resilience. The stock has since appreciated 72.68%, validating leadership confidence.

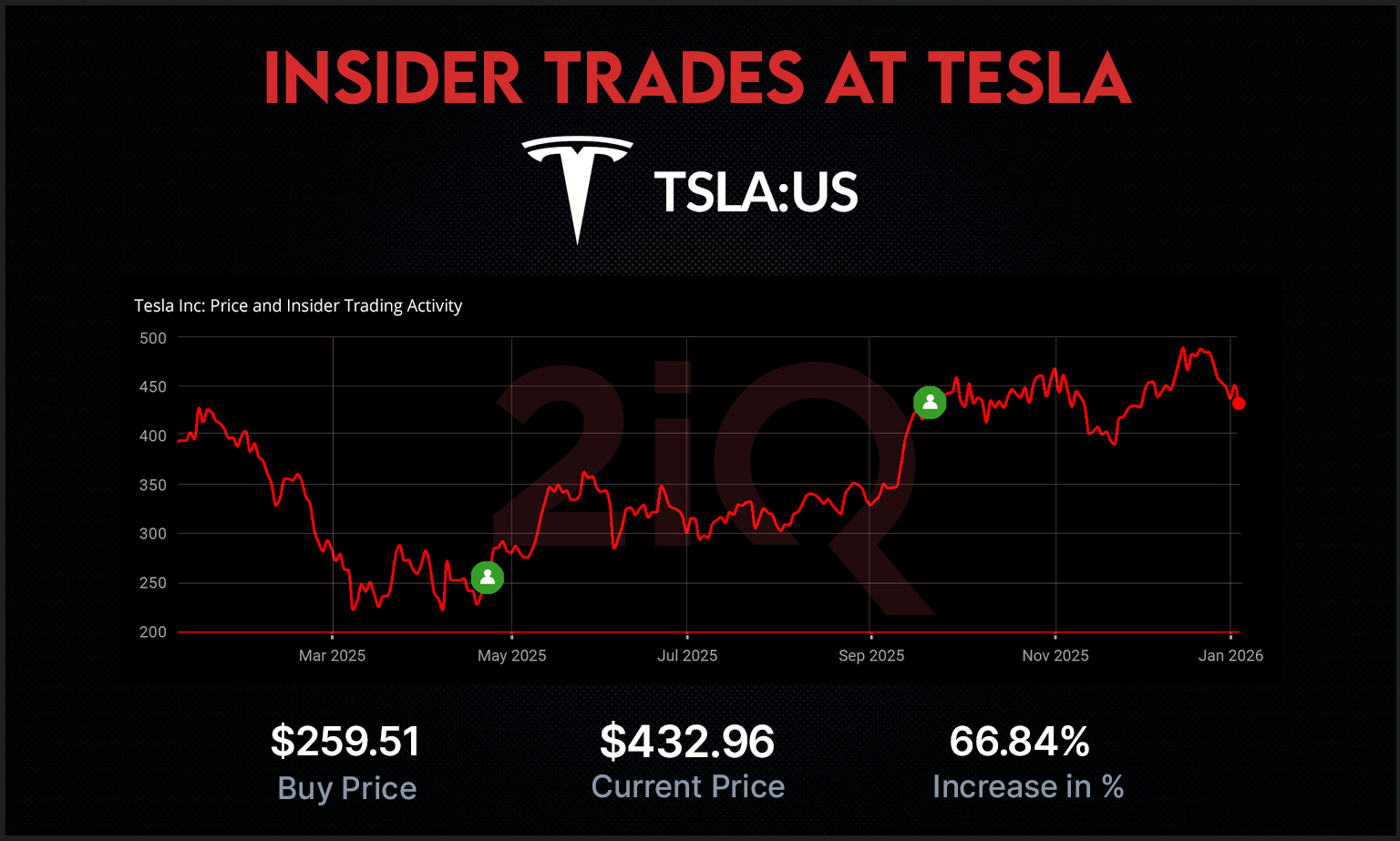

Tesla, Inc: Joe Gebbia Signals Boardroom Confidence with $1M Buy

Elon-powered Tesla, Inc. (TSLA:US), the S&P 500 electric vehicle and sustainable energy powerhouse, continues to innovate amid mounting financial pressures and international uncertainties. In a rare move, board member Joe Gebbia made the first insider stock purchase since 2020.

On April 24, 2025, Gebbia acquired 4,000 shares at an average price exceeding $250 per share, totaling over $1 million, signaling strong personal commitment to Tesla’s long-term trajectory.

Tesla’s Q1 2025 results painted a mixed picture: GAAP net income of $0.4 billion, non-GAAP net income of $0.9 billion, and cash reserves of $37 billion. While stock prices fell 29% year-to-date due to softening EV demand and international market pressures, Gebbia’s purchase reflects renewed optimism about Tesla’s direction.

With ongoing expansions in Model Y production, autonomous vehicle integration, and AI-driven innovations, Tesla remains focused on growth beyond the traditional EV market. Gebbia’s buy marks a rare insider vote of confidence, contributing to a 68.81% stock appreciation since his purchase.

Illumina Inc: Top Executives Bet on Genomics Growth

Illumina Inc. (ILMN:US), a global leader in DNA sequencing and array-based technologies, witnessed unprecedented insider buying in May 2025. CEO Jacob Thaysen purchased 12,350 shares over two days, spending roughly $998,674, while CFO Ankur Dhingra acquired 6,100 shares for $495,381.

These transactions coincided with the release of DRAGEN v4.4, Illumina’s most advanced genomic analysis software, enhancing oncology applications and multiomics capabilities. Q1 FY25 results showed GAAP EPS of $0.82 and revenue of $1.04 billion, despite tempered full-year guidance due to macro and China-related headwinds.

By personally investing at market price an unprecedented move for Illumina insiders Thaysen and Dhingra signaled confidence in the company’s long-term prospects. Since these trades, Illumina’s stock rose 67.31%, reflecting renewed investor optimism.

Estée Lauder Companies: Board Confidence Amid Financial Challenges

Estée Lauder Companies Inc. (EL:US), a leader in prestige beauty, faced financial headwinds in early 2025, including Q2 operating losses of $580 million and workforce reductions of up to 7,000 jobs. Yet insiders showed confidence through key purchases.

CFO Akhil Shrivastava acquired 700 shares ($46K), while Director Paul Fribourg purchased 132,500 shares (~$8.7M), underscoring belief in the company’s long-term recovery. As of February 10, 2025, the stock traded at $65.03, representing a 49.65% rise from the insider purchase price, reflecting investor recognition of leadership commitment.

Quanterix Corporation: $2M Insider Buying Spree Signals Confidence

Quanterix Corporation (QTRX:US), a life sciences firm specializing in ultra-sensitive biomarker analysis, saw multiple insiders purchase stock between June 6 -13, 2025. Founding Director David R. Walt bought over 370,000 shares across four transactions, totaling $2.1 million and increasing his holdings to 1.87 million shares.

Director William P. Donnelly acquired 93,113 shares ($506K), and CEO Masoud Toloue bought 45,900 shares ($248K). These buys coincided with a strategic period for the company, including Q1 earnings reporting, operational restructuring, and a pending merger with Akoya Biosciences.

Quanterix reported revenue of $30.3 million (-5% YoY), net loss of $20.5 million, and a cash balance of $269.5 million. Management targets $30 million in annual cost cuts and positive cash flow by 2026. Insider purchases totaling over $2.8 million reflect strong confidence in the company’s strategic direction, even amid financial restructuring. Quanterix’s stock has risen 29.45% since the trades.

Conclusion

The top insider trades of 2025 highlight how company leadership can provide unique signals about future performance. From Tesla’s rare boardroom buy to coordinated purchases at Commerzbank, these trades underscore confidence in both established giants and sector innovators. For investors, following insider activity continues to be a powerful strategy to gauge long-term growth potential.

Latest Stories

Major Insider Accumulation at HLNE: $3.2M Buys Post-Pullback

Varonis Insiders Deploy $1.1M After Post-Earnings Plunge

Ralliant’s Insider Cluster Signals Long-Term Confidence Amid EV Headwinds

CVCO Insiders Buy the Dip After Earnings Shock

Insiders Signal Bullish Outlook on Crane with Strategic Purchases