Cooper Companies Leadership Backs Stock as Earnings Momentum Builds

Cooper Companies (COO:US), the San Ramon-based global medical device leader, continues to shape the future of eye care and women’s health through its two core divisions, CooperVision and CooperSurgical. With over 16,000 employees, products sold in more than 130 countries, and a mission to improve the lives of over fifty million people each year, the company remains a trusted name in both contact lenses and fertility solutions.

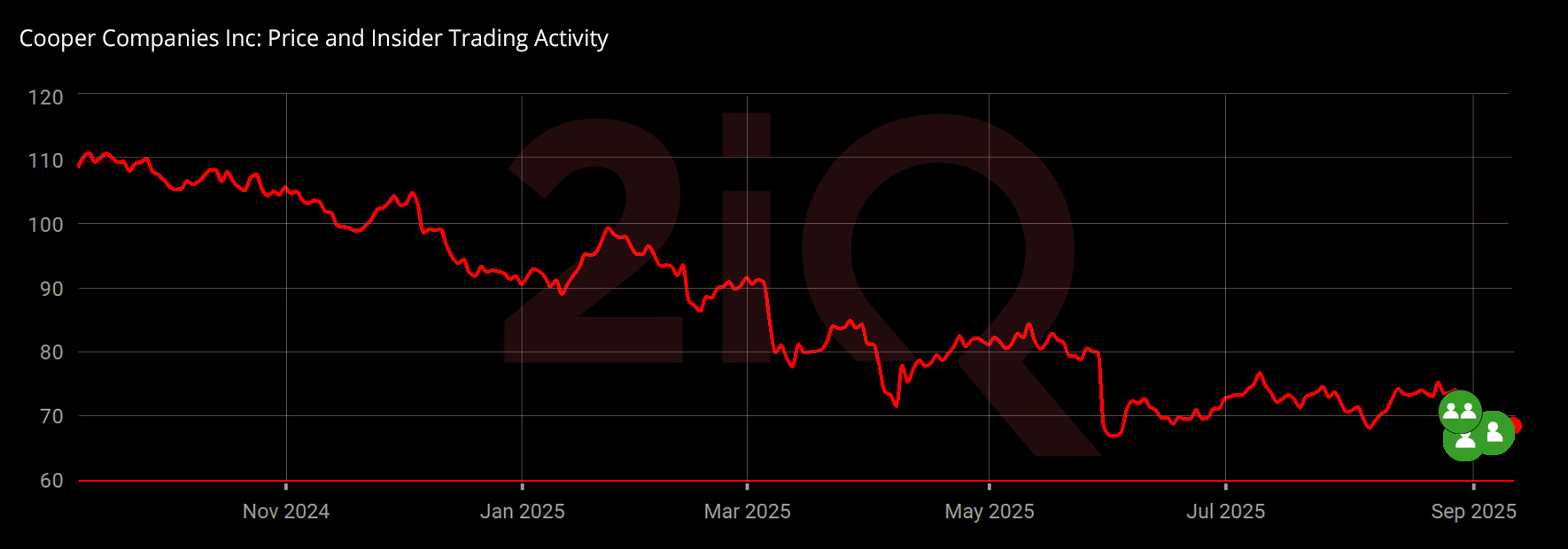

Insider Buying Highlights Strong Leadership Conviction

In early September 2025, Cooper’s leadership team sent a strong signal of confidence through synchronized insider purchases exceeding $1 million.

Albert G. White III (President & CEO) acquired 10,000 shares at $68.39, spending $690,033 and boosting his holdings to 226,151 shares.

Daniel G. McBride (COO) purchased 3,000 shares at $65.04, worth $194,408, lifting his stake to 63,120 shares.

Brian G. Andrews (CFO) bought 1,525 shares at $65.68, valued at $99,796, raising his total to 22,191 shares.

Jerry Warner (President & Director) added 1,450 shares at $69.23, spending $101,283 to increase his holdings to 18,319 shares.

Alongside these moves, directors also joined in, reinforcing unified conviction from the boardroom to the C-suite in Cooper’s long-term growth trajectory.

About the Insiders

Albert White has led Cooper as CEO since 2018, after previously serving as CFO and Chief Strategy Officer. Daniel McBride, a Stanford-trained lawyer, has been with Cooper for two decades and played a pivotal role in building CooperVision. CFO Brian Andrews brings deep financial expertise with over 20 years at the company, while Jerry Warner, now President of CooperVision, has extensive experience in global eye care markets. Their combined leadership underscores both operational depth and strategic vision, making the recent insider buying even more noteworthy.

Financial Backdrop

For the fiscal third quarter ended July 31, 2025, CooperCompanies reported revenue of $1.06 billion, up 6% year-over-year. CooperVision contributed $718.4 million, while CooperSurgical added $341.9 million. GAAP EPS came in at $0.49, down 6% from last year, but non-GAAP EPS rose 15% to $1.10, supported by operational efficiency and robust free cash flow of $164.6 million. Gross margin held at 65% on a GAAP basis, while non-GAAP gross margin expanded to 67%, reflecting efficiency gains and favorable mix.

Looking Ahead

CEO Albert White highlighted margin strength, double-digit earnings growth, and an upbeat earnings guidance for fiscal 2026, driven by the MyDAY® product line. With strong insider conviction, expanding cash flow, and a strategy centered on sustainable growth, CooperCompanies is positioning itself as a resilient player in global healthcare markets.

Latest Stories

Novocure Stock Sees Heavy Insider Buying Amid Clinical Progress

Eastman Leadership Rallies Behind Stock Amidst Mixed Results

Coty Insiders Buy Over $1.3M in Shares After Earnings Miss

Hays Leadership Shows Faith in Stock While Markets Remain Skeptical

Energy Transfer’s Exec Chairman Invests $34M Amid Expansion Plans