$26M Insider Buy Underscores Confidence in Kinder Morgan

Kinder Morgan, Inc. (KMI:US) stands as one of North America’s largest energy infrastructure companies, operating an expansive network of approximately 79,000 miles of pipelines and 139 terminals. The Houston-based firm transports natural gas, crude oil, CO₂, and refined products while also managing renewable fuel storage and handling. With more than 700 billion cubic feet of working natural gas storage capacity, Kinder Morgan plays a central role in supporting reliable and efficient energy delivery across the continent.

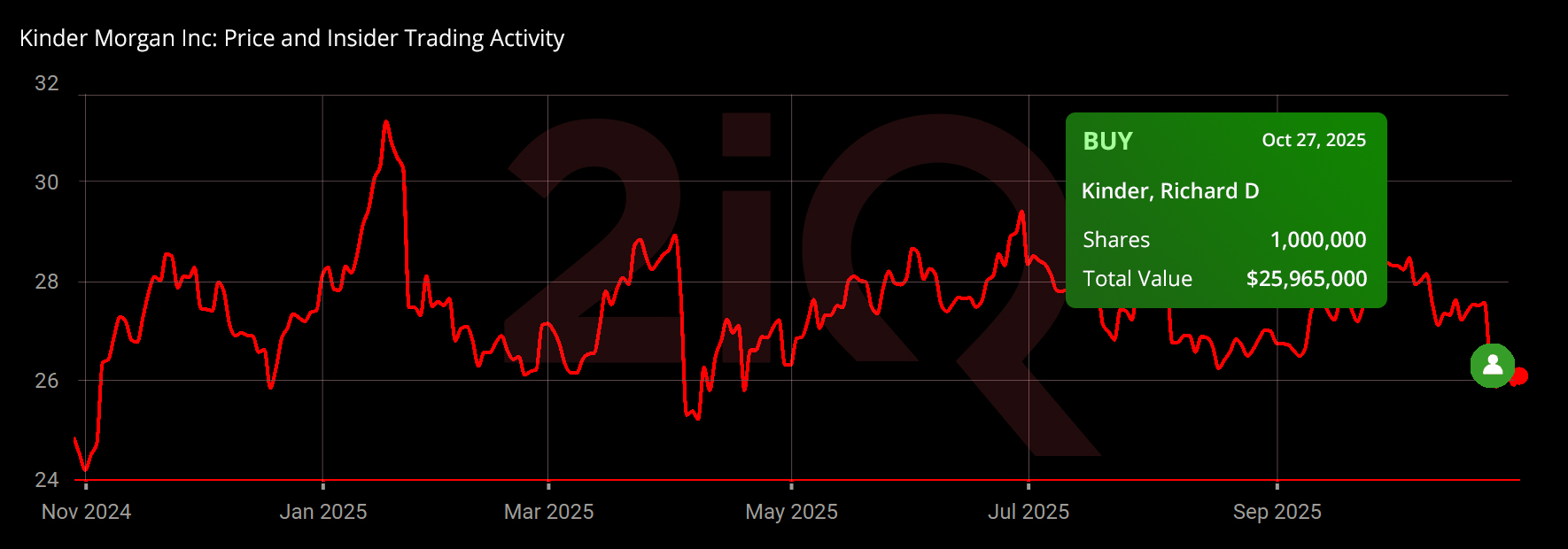

Insider Buying Activity

Executive Chairman Richard D. Kinder, the company’s co-founder and namesake, demonstrated unwavering confidence in Kinder Morgan’s future with a major insider purchase on October 27, 2025. Kinder acquired 1,000,000 shares of Class P Common Stock at an average price of $25.97, investing nearly $25.97 million. This transaction raised his total holdings to approximately $246.21 million shares, making it one of the most significant insider buys in recent quarters. His consistent accumulation underscores long-term faith in Kinder Morgan’s business model and financial stability amid evolving energy market dynamics.

Financial Performance and Strategic Outlook

Kinder Morgan’s third-quarter 2025 results reflected steady performance and disciplined growth. Net income rose slightly to $628 million, while adjusted net income climbed 16% year-over-year to $648 million. Adjusted EBITDA increased 6% to $1.99 billion, and adjusted EPS advanced to $0.29. The company also declared a quarterly dividend of $0.2925 per share, up 2% from the previous year. CEO Kim Dang highlighted robust contributions from Kinder Morgan’s Natural Gas, Products Pipelines, and Terminals segments, along with strong free cash flow of $0.6 billion and a solid leverage ratio of 3.9x.

Strategically, Kinder Morgan is advancing two major pipeline projects: the Western Gateway Pipeline with Phillips 66, enhancing refined product transport from Texas to the West Coast, and the SFPP East Line expansion, increasing diesel and fuel capacity from El Paso to Tucson.

Why the Insider Buy Matters

Kinder’s multi-million-dollar purchase reinforces his deep-rooted confidence in the company’s resilient infrastructure, disciplined capital strategy, and expanding pipeline network, strong signals of continued shareholder value creation in the energy transition era.

Latest Stories

Founder Robert Steers Makes Major Insider Buys at Cohen & Steers

Sound Point Meridian Executives Boost Confidence with Big Insider Buys

Clustered Insider Buying at Paragon Care Signals Executive Confidence

Industrivarden’s Investment Shows Strong Faith in Volvo’s Green Transition

Insider Buying Wave Signals Renewed Confidence at Chicago Atlantic