What’s Behind the Insider Buying Surge at Kiwetinohk Energy Corp?

Kiwetinohk Energy Corp. (KEC:CN) is a Canadian energy company focused on the production of natural gas, oil, and natural gas liquids. The company also develops renewable and gas-fired power projects, alongside early-stage carbon capture initiatives in Alberta. With a market capitalization of approximately CAD 1.02 billion, Kiwetinohk is positioning itself as a multi-faceted energy player in transition.

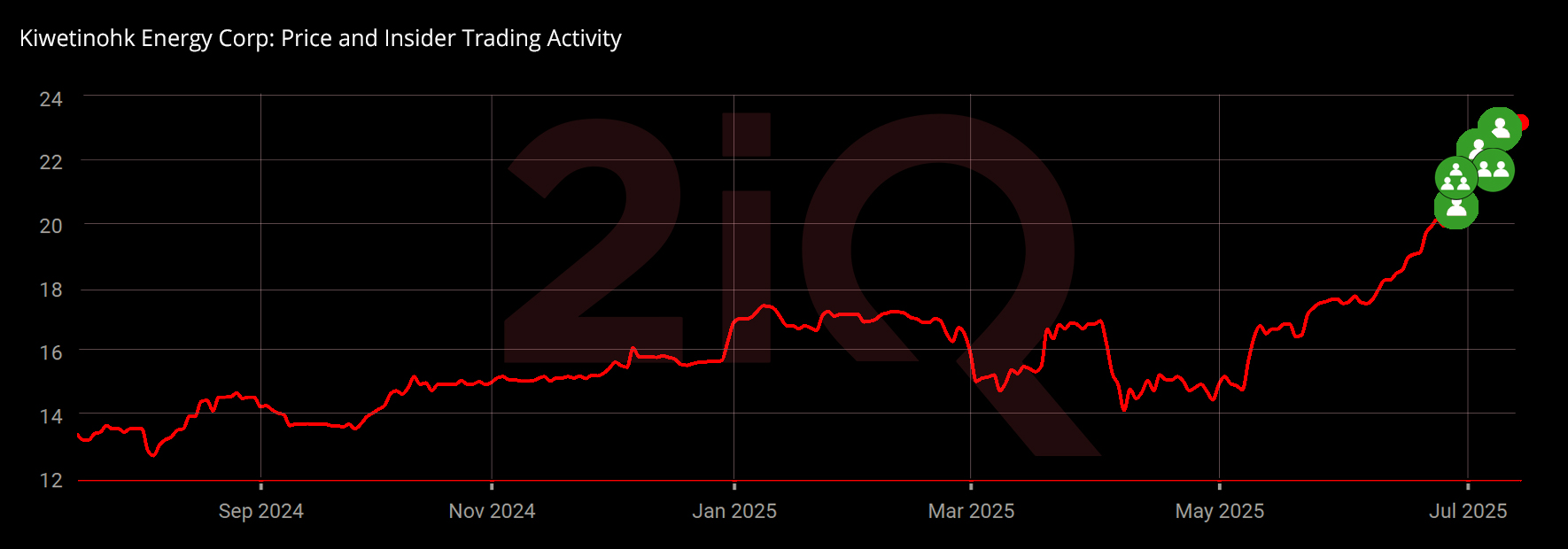

Insiders Load Up on Kiwetinohk Stock

Between June 24 and July 10, 2025, several top executives at Kiwetinohk Energy Corp bought company stock in open-market transactions, a strong indication of internal confidence in the company’s long-term outlook.

Here’s a breakdown of key insider purchases:

Fareen Sunderji (President) acquired 2,000 shares at CAD 22.98 on July 10, with a total investment of around CAD 45,972.

Patrick Beverley Carlson (CEO) purchased 13,000 shares at CAD 23.35 on July 7 and another 20,200 shares at CAD 21.574 on July 3, totaling over CAD 739,344.

Jakub Brogowski (CFO) bought 25,000 shares at CAD 20.239 on June 24, investing CAD 505,975.

Steven William Sinclair (Independent Director) picked up 20,000 shares at CAD 20.25 on June 26, amounting to CAD 405,000.

Other insiders, including VPs, SVPs, and Independent Directors, made additional purchases during the same period, collectively investing over CAD 2,161,057.

When senior leadership makes such significant and clustered stock purchases, it often signals a bullish outlook on the company’s valuation and future performance. This wave of insider buying at Kiwetinohk suggests strong internal conviction in the firm’s strategic direction and potential growth.

What Do These Buys Tell Us?

This broad-based insider accumulation, led by the CEO and CFO, suggests a unified vote of confidence across Kiwetinohk’s executive leadership and board. Insider buying is particularly meaningful when it follows a major strategic shift and in this case, it closely trails the company’s announcement of a formal business strategy review.

Moreover, the magnitude and clustering of these transactions occurring within a tight 2-week window signals urgency and optimism among insiders, possibly in anticipation of developments from the ongoing portfolio reevaluation and asset divestiture efforts.

Recent Financial Results and Strategic Developments

Kiwetinohk reported robust Q1 2025 results on May 7, delivering record production of 32,611 boe/d and its first-ever quarter of positive free funds flow, totaling $29.5 million. Complementing upstream gains, the sale of its Opal gas-fired power project generated $21 million in proceeds, supporting a stronger balance sheet and upward revisions to annual guidance.

Just weeks later, on June 23, the company launched a formal business strategy review, aimed at evaluating value-enhancing opportunities and exploring an orderly exit from its power business. The process, backed by advisors from RBC Capital Markets and National Bank Financial, is designed to sharpen Kiwetinohk’s focus on its core upstream operations and potentially unlock shareholder value.

With improved guidance and a potential exit from the power segment under review, Kiwetinohk may be entering a pivotal growth phase, underscored by this strong wave of insider cluster buying.

Latest Stories

Major Insider Accumulation at HLNE: $3.2M Buys Post-Pullback

Varonis Insiders Deploy $1.1M After Post-Earnings Plunge

Ralliant’s Insider Cluster Signals Long-Term Confidence Amid EV Headwinds

CVCO Insiders Buy the Dip After Earnings Shock

Insiders Signal Bullish Outlook on Crane with Strategic Purchases