Wayfair Stock: Short Sellers See Further Downside

If a stock has a high level of short interest, investors need to be careful. Short sellers are sophisticated, high-conviction traders. If they’re shorting a stock, it’s because they have spotted a major risk.

In this report, we are going to look at the short interest data on Wayfair Inc (W:US). Wayfair is an online retailer that sells furniture, decor, housewares, seasonal decor, and other home goods. It is one of the world’s largest online destinations for home goods. The company is listed on the New York Stock Exchange and currently has a market capitalization of approximately $3.98 billion.

High Short Interest

Wayfair stock has experienced a major collapse over the last 18 months or so. Back in October 2021, the stock was trading above $200. Today, however, it is under $40.

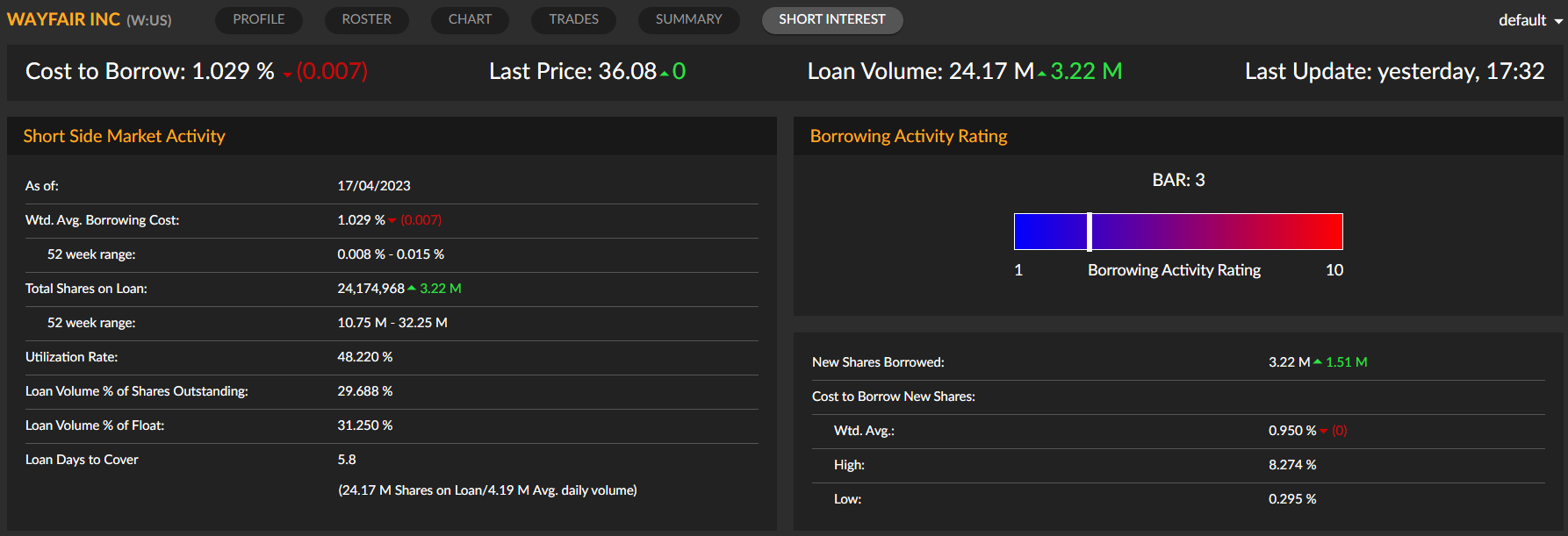

The short sellers appear to see further downside though. We say this because, at present, 24.17 million Wayfair shares are on loan. That represents around 31.25% of the free float.

What’s interesting is that short interest here has been steadily rising over the last 12 months. This time last year, only around 13 million shares were on loan. Since then, the figure has nearly doubled. This indicates that hedge funds have been growing more bearish on the stock recently.

What Do the Short Sellers See Here?

As for why the short sellers are targeting Wayfair right now, it is most likely related to the fact that the company is struggling due to weak economic conditions.

In February, Wayfair reported a 4.6% year-over-year decline in revenue for the fourth quarter of 2022 (international revenue was down 20%), and a net loss of $351 million. The company also reported that it ended 2022 with 22.1 million active customers, a decrease of approximately 19% year on year.

“Consumer sentiment remains under pressure given the uneven state of the economy, with higher interest rates and housing data,” commented Wayfair CEO Niraj Shah.

It could also be related to the fact that the company is not expected to be profitable any time soon. At present, Wall Street expects Wayfair to generate a net loss of $1048 million this year, followed by a net loss of $793 million next year. Now that financial conditions are much tighter than they were, investors don’t have a lot of time for unprofitable companies.

Given the high level of short interest here, we think caution is warranted towards the stock. Generally speaking, heavily-shorted stocks tend to underperform.

Latest Stories

Grizzly Short Hits Trustpilot Amid Harsh Review-Manipulation Claims

Grindr Surges After Billionaire Owner Withdraws Buyout Bid and Buys Shares

Leadership Betting on the Adtran Holdings’ Future

Tutor Perini Leadership Shows Confidence with Multi-Million Dollar Buys

Arbor Realty Trust Sees Bold Insider Buying Amid Market Lows