Short Sellers Are Targeting Green Hydrogen Stock ITM Power

Short interest data can help investors avoid large losses. Research shows that short sellers are skilled at identifying investment risks. If they’re shorting a stock, there’s usually a good reason they are doing so.

In this report, we are going to look at the short interest data on ITM Power PLC (ITM:LN). ITM Power is a renewable energy company that specializes in green hydrogen solutions. The company, which is based in the UK, has partnerships with a number of major industrial and energy businesses including Linde, Shell, and Snam. It’s listed on the Alternative Investment Market (AIM) of the London Stock Exchange and currently has a market cap of approximately £601.25 million.

ITM Power Has High Short Interest

Looking at the data on ITM Power, we see a couple of red flags.

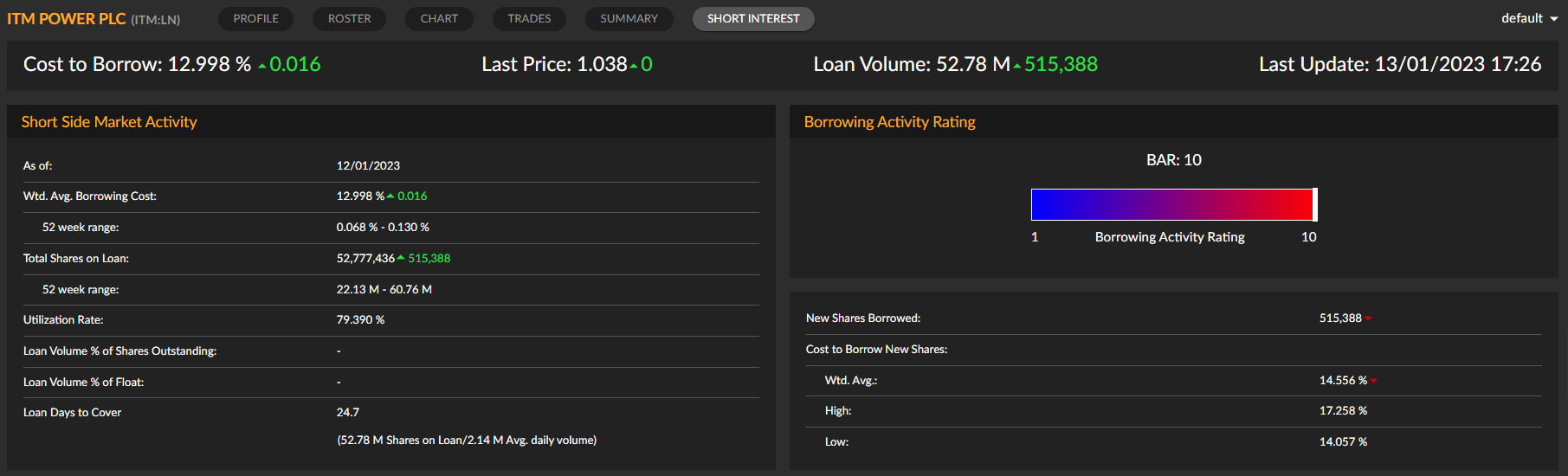

One is that short interest is quite high: At present, 52.78 million ITM shares are on loan which equates to around 12.5% of the free float. That makes ITM Power one of the most shorted stocks on the London Stock Exchange at present.

Another red flag is that utilization (a measure of demand on the short side) and the cost to borrow stock are relatively high at 79.39% and 12.99% respectively. These figures indicate that the stock is attracting a lot of interest from short sellers right now.

Why Are Short Sellers Targeting ITM Power?

As for why the short sellers are sniffing around here, it could be down to the fact that in December, the company deferred its planned trading update. This could indicate that the company is experiencing some challenges right now.

It’s worth noting that ITM Power has a poor track record when it comes to meeting revenue forecasts. In recent years, analysts have had to continually revise their revenue forecasts for the company down. Back in October, the stock fell 35% after the company warned that revenue for this financial year would be towards the bottom of its guidance range.

Alternatively, it could be down to ITM Power’s lack of profitability. This financial year, the company is projected to post a net loss of £57 million.

Of course, it could simply be related to the stock’s valuation. For the year ending 30 April 2023, ITM Power is forecast to generate sales of £24.7 million. That puts the company’s price-to-sales ratio at about 24, which is high.

Whatever it is the short sellers are focused on here, we think caution is warranted toward the stock. More often than not, heavily-shorted stocks underperform in the near term.