Insider Buying Report: Suncor Energy Inc (SU:CN)

Insiders have access to real-time information on their companies and often also have a wealth of experience and knowledge that can help them evaluate their firms’ prospects. If they are loading up on company stock, it’s generally worth taking a closer look.

In this report, we are going to highlight some interesting insider buying at Suncor Energy Inc (SU:CN). Suncor is a Canadian integrated energy company. Headquartered in Calgary, it is focused on developing one of the world’s largest petroleum resource basins – the Athabasca oil sands in northeastern Alberta, Canada. The company is listed on the Toronto Stock Exchange and the New York Stock Exchange and currently has a market capitalization of CAD $54.20 billion.

Suncor Energy: Insider Buying

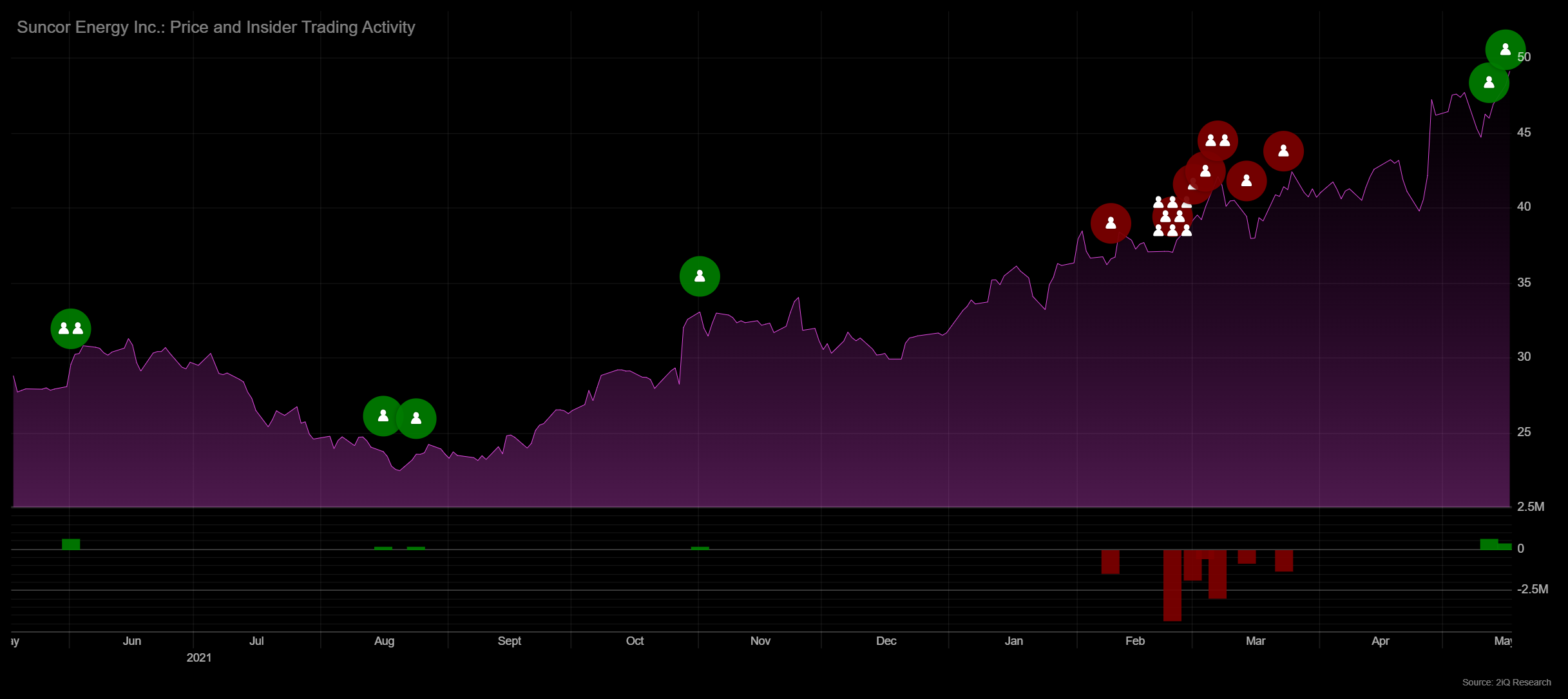

Our insider transaction data shows that between May 12 and May 16, two insiders at Suncor Energy Inc bought stock. Those who bought shares were:

Board member Russ Girling (20,000 shares at CAD $44.94 per share)

Board member Mike Wilson (6,270 shares at CAD $48.04 per share)

In total, the two insiders spent a little over $1 million on Suncor Energy stock.

Energy Expert

This trading activity is worth highlighting for several reasons.

Firstly, Mr. Girling – who joined the board in May 2021 – has considerable experience in the energy industry. Previously, he served as President and CEO of TransCanada Pipelines Limited and TC Energy Corporation, a North American energy infrastructure company, for 10 years. Before this, he was CFO at TC Energy. And prior to joining TC Energy in 1994, he worked at Suncor Energy, Northridge Energy Marketing, and Dome Petroleum. So, he is likely to have a very good understanding of the industry.

Secondly, Mr. Girling has made well-timed purchases in the recent past. Our data shows that the insider bought stock in November last year when it was trading near CAD $33. Since then, the share price has risen as high as $48.

Third, Mr. Girling has made a substantial purchase here. The fact that the insider has spent nearly $700,000 on stock, and boosted the size of his holding significantly, suggests that he is very confident the stock is set to move higher.

Record Results

Suncor recently posted very strong Q1 results on the back of the surge in commodity prices.

For the quarter, the group generated adjusted funds from operations of CAD $4.1 billion, or $2.86 per share – the highest figure in the company’s history.

Meanwhile adjusted operating earnings for the quarter increased to $2.76 billion ($1.92 per common share), compared to $746 million ($0.49 per common share) in the prior year quarter.

As a result of these strong earnings, the group raised its quarterly dividend by 12% to CAD $0.47 per share. The board also approved an increase to the company’s share buyback program.

Since these results, a number of brokers have raised their price targets for the stock. JP Morgan, for example, has lifted its target price to CAD $54 from $52.

In light of these developments, we see the insider buying here as a bullish indicator.

Latest Stories

Grizzly Short Hits Trustpilot Amid Harsh Review-Manipulation Claims

Grindr Surges After Billionaire Owner Withdraws Buyout Bid and Buys Shares

Leadership Betting on the Adtran Holdings’ Future

Tutor Perini Leadership Shows Confidence with Multi-Million Dollar Buys

Arbor Realty Trust Sees Bold Insider Buying Amid Market Lows