Insider Buying: Masimo CEO Buys $6 Million Worth of Company Stock

If a CEO is buying company stock, it’s often worth investigating the stock further. CEOs tend to have an intimate understanding of their businesses and are usually way ahead of analysts and portfolio managers when it comes to revenue and earnings trends.

In this report, we are going to highlight some substantial buying activity from the CEO of Masimo Corp (MASI:US). Masimo is a medical technology company that develops, manufactures, and markets a variety of noninvasive monitoring solutions. It provides products to hospitals, emergency medical service providers, home care providers, long-term care facilities, physician offices, veterinarians, and consumers. The company is listed on the Nasdaq and currently has a market cap of $7.64 billion.

Insider Buying at Masimo Corp

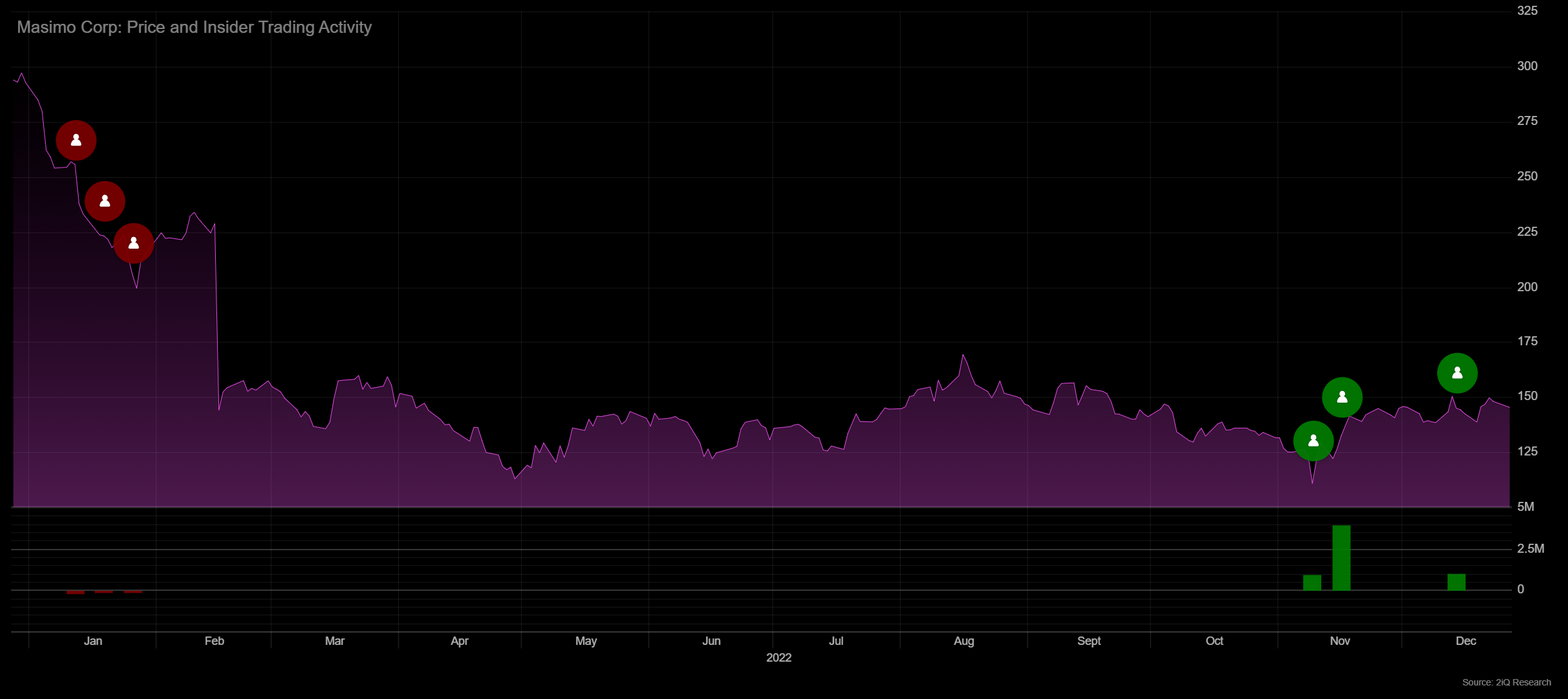

Our data shows that Masimo’s CEO and Founder Joe Kiani has made three large stock purchases recently:

November 11 – 7,784 shares @ $129.27 per share

November 14 – 31,994 shares @ $123.99 per share

December 15 – 7,040 shares @ $144.79 per share

In total, the insider has spent around $6 million on Masimo stock.

Bullish Trading Activity

There are unlikely to be many people who know Masimo better than Mr. Kiani. He started the company from his condominium back in 1989 and has served as CEO since then. He is listed as the inventor on more than 500 of the company’s patents or patent applications for advanced signal processing, optical sensors, and wearable technologies.

Our records show that Mr. Kiani doesn’t buy company stock very often. In fact, the last time he purchased stock was June 2012. This suggests that he sees a lot of value in the stock right now. Our Insider Model views his trading activity as bullish.

Q3 Earnings Beat

In November, Masimo posted a solid set of Q3 results that were ahead of analysts’ estimates.

For the quarter ended October 1, 2022, total revenue came in at $549.30 million, up 78.7% year on year (boosted by the acquisition of Sound United), and ahead of the consensus forecast of $533.44 million. Healthcare revenue was $327 million, representing 6% reported growth and 10% constant currency growth.

Adjusted earnings per share for the quarter amounted to $1.00, comfortably above the consensus forecast of 92 cents.

More recently, in mid-December, Masimo laid out plans detailing the next phase of its growth trajectory. Looking ahead, the company plans to enter new markets related to wearables, hearables, and telemonitoring. It believes its deep capabilities and extensive IP in patient monitoring technologies will allow it to offer highly differentiated products in these markets, which have an aggregate total addressable market (TAM) of more than $150 billion.

Clearly, Mr. Kiani is confident in relation to the growth story here.

We see his buying activity as a bullish indicator.

Latest Stories

Insiders Signal Bullish Outlook on Crane with Strategic Purchases

The Buyback Dataset: Tracking Corporate Share Repurchases

Insiders Buy USA Rare Earth as Supply Chains and Policy Align

Inside NCC Group: Board-Level Buying Points to Growing Confidence

Short Selling: A Clear Look Into Market Pressure and Bearish Sentiment