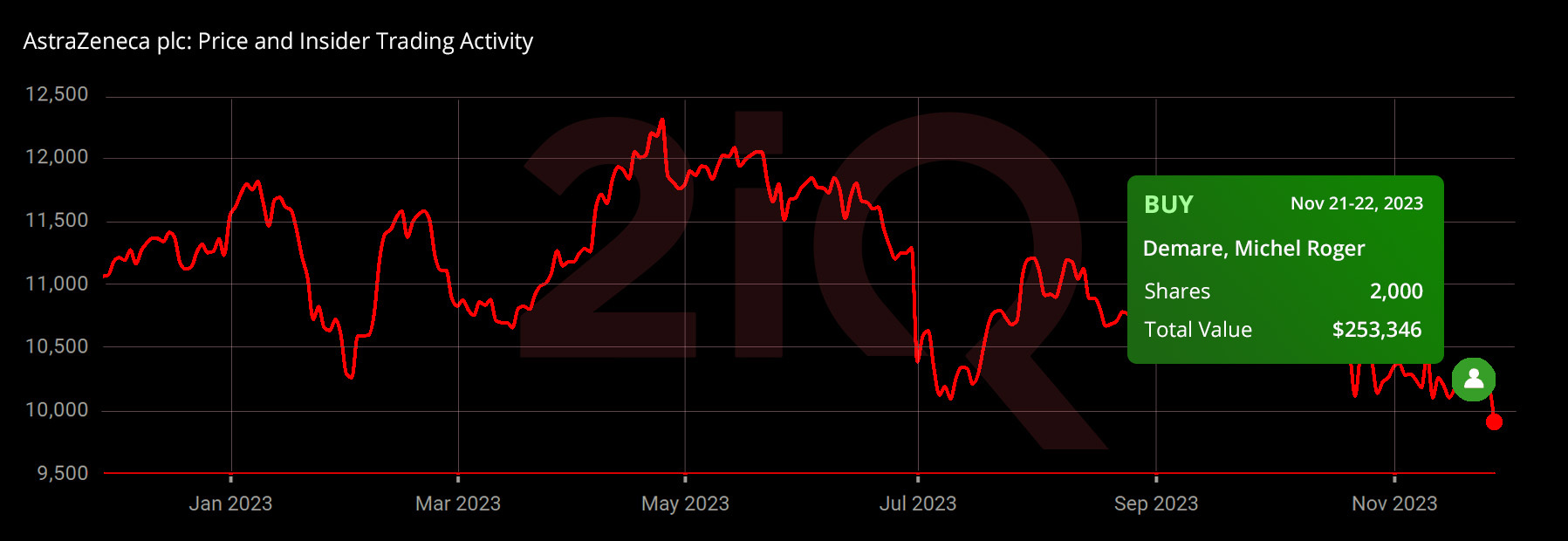

Chairman at AstraZeneca Stocked Up for the Third Time in 2023

AstraZeneca PLC (AZN:UK) is a global biopharmaceutical company engaged in the development and commercialization of prescription medicines across various therapeutic areas. Established in 1992 and rebranded from Zeneca Group PLC in 1999, the Anglo-Swedish company’s global headquarters are in Cambridge, UK. Presently, it boasts a market capitalization of almost $157.8 billion on the London Stock Exchange.

Insider Strategic Investment

Michel Roger Demaré, Chairman of the Board, acquired a total of 2,000 shares on November 21 and 22 at £101.5 and £101.7 per share, totaling £202,750 ($255,906). What adds significance to these trades is that these trades represent his third investment in the company in 2023, breaking a trading silence of over three years, with the initial purchase on April 28 at £117.01 per share.

Michel Demaré, currently the Non-Executive Chair of the Board, joined the board in September 2019 and became Chair in April 2023. Previously, he served as Vice-Chairman of UBS Group AG from 2010 to 2019.

Stellar Year for Excellence

In 2023, AstraZeneca achieved notable success through robust investment and strategic initiatives. The company received support from its chairman and garnered praise from the Financial Secretary, Paul Chan, for establishing a research and development center and innovation park in Hong Kong.

A licensing agreement with Astex Pharmaceuticals for a new breast cancer treatment, Truqap plus Faslodex, marked the third successful collaboration between the two companies in the last five years.

Robust Financial Performance

In addition to some outstanding performance developments, the company reported exceptional results for Q3 2023, with a total revenue of $33,787 million, a 5% increase despite a $2,896 million decrease in COVID-19 medicine sales. Excluding COVID-19 medicines, both total revenue and product sales surged by 15%. Oncology medicines rose by 20%, CVRM by 19%, R&I by 9%, and Rare Disease by 12%.

Furthermore, the core operating margin increased to 35%, a three-percentage-point rise. Core EPS soared by 17% to $5.80, and FY 2023 core EPS is expected to grow by a low double-digit to low-teens percentage at CER, including a $712 million gain from updated contractual relationships for Beyfortus in core other operating income.

Latest Stories

Insider Buying & Strategic Shifts Highlight Renewed Optimism Around Volvo’s Outlook

Tesla Board Member Makes Rare $1M Stock Buy – A Reversal Signal for TSLA?

Calavo Insiders Bet Millions on a Rebound—And Get It

$11M Insider Bet on Dip Pays Off – MSC Chairman Up Nearly $1M as Stock Surges

After the Drop, Bunzl Execs Clustered Trades Signal Long-Term Confidence