Two Insiders at United Airlines Just Bought Stock

Insider transaction activity can help investors cut through the data overload. Insiders are some of the most informed participants in the market meaning their buying and selling activity can provide investors with valuable insights.

In this report, we are going to highlight some interesting insider buying at United Airlines Holdings Inc (UAL:US). United Airlines is a major American airline company. By fleet size and number of routes, it is the third-largest airline in the world. The company is listed on the Nasdaq and currently has a market cap of approximately $12.51 billion.

Insider Buying at United Airlines

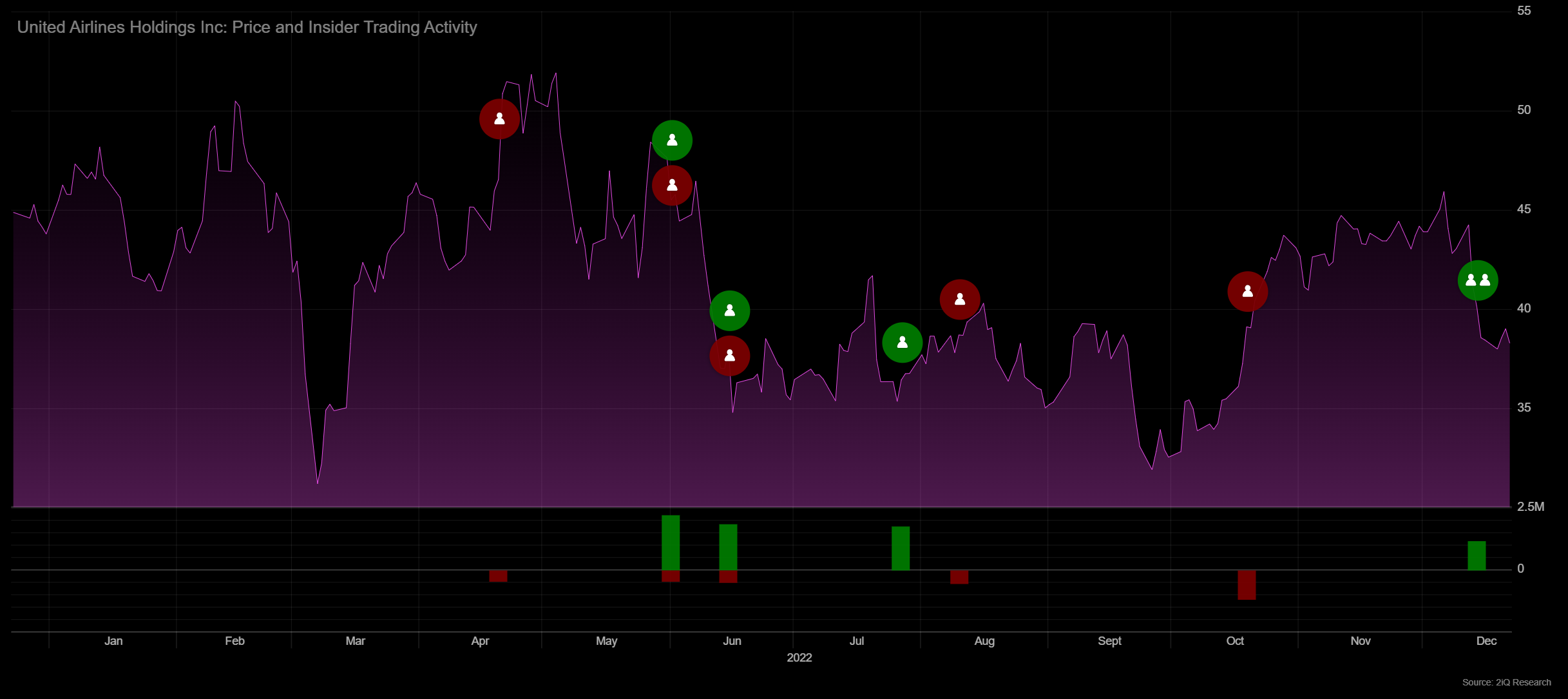

Our data shows that between December 14 and December 15, two insiders at United Airlines bought stock.

Those who picked up shares were:

Director James Kennedy (5,000 shares @ $39.33 per share)

Director Edward Shapiro (25,000 shares @ $39.79 per share)

Combined, the insiders invested around $1.19 million in UAL stock.

Investment Expertise

Both of these insiders have investment backgrounds.

Mr. Kennedy is the former President and CEO of T. Rowe Price Group, a global investment management organization that provides mutual funds, sub-advisory services, and institutional asset management. Kennedy has been a member of United Airlines' board of directors since 2016; this case marks his first insider buying since in his tenure. Overall, he has more than 35 years of experience in the investment management industry.

Meanwhile, Mr. Shapiro previously served as a Managing Partner of PAR Capital Management, where he specialized in travel, media, and Internet-related companies. Before this, he was a Vice President at Wellington Management Company. Shapiro is a frequent trader of company stock, having bought and sold stock worth in millions since 2018.

Given their backgrounds, these insiders are likely to have a good understanding of the stock’s potential.

Strong Q3

United Airlines recently posted strong Q3 results, beating expectations on operating revenue, unit costs, and adjusted operating margin.

For the period, total operating revenue came in at $12.9 billion, up 13.2% compared to the third quarter of 2019. Meanwhile, total revenue per seat mile (TRASM) was up 25.5% compared to the third quarter 2019.

The company advised that this was one of its best Q3s in its history.

Looking ahead, United said that it expects the strong passenger demand to overcome the recessionary pressures in the macroeconomic environment. It also said that it expects Q4 adjusted operating margin to be above 2019 levels for the first time.

"Despite growing concerns about an economic slowdown, the ongoing Covid recovery trends at United continue to prevail and we remain optimistic that we'll continue to deliver strong financial results in the fourth quarter, 2023 and beyond," said CEO Scott Kirby.

In light of these results, we see the insider buying here as a bullish indicator.

Latest Stories

Grizzly Short Hits Trustpilot Amid Harsh Review-Manipulation Claims

Grindr Surges After Billionaire Owner Withdraws Buyout Bid and Buys Shares

Leadership Betting on the Adtran Holdings’ Future

Tutor Perini Leadership Shows Confidence with Multi-Million Dollar Buys

Arbor Realty Trust Sees Bold Insider Buying Amid Market Lows